Understanding the Impacts of IRS Levies

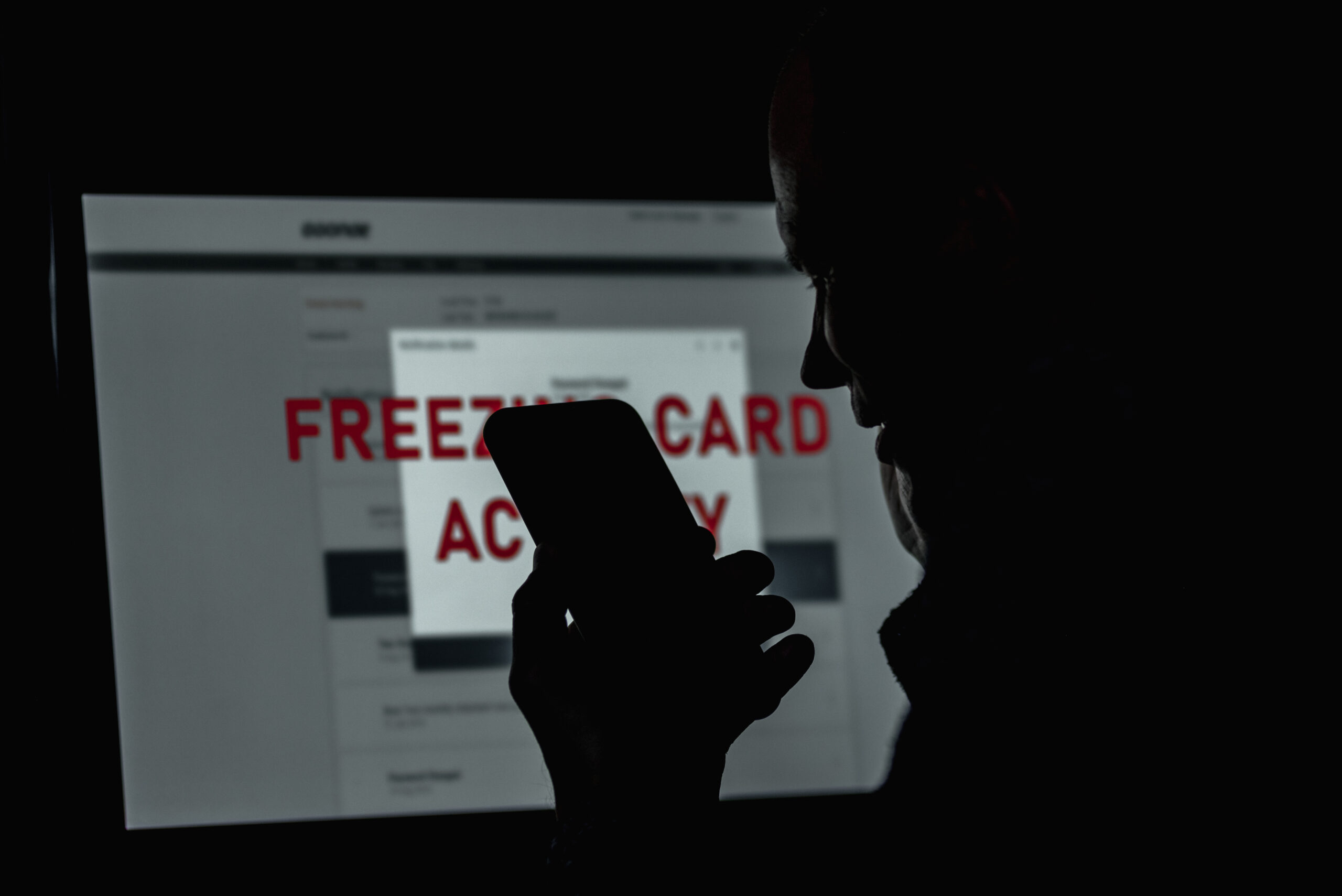

IRS levies can have significant consequences on your financial stability. When the IRS seizes your assets or freezes your bank account, it can disrupt your ability to pay bills, access funds for daily expenses, and maintain your standard of living. The stress of dealing with such actions can also affect your mental well-being and relationships.

Moreover, the implications of an IRS levy extend beyond immediate financial distress. It can lead to long-term damage to your credit score, making it challenging to secure loans or mortgages in the future. Understanding these impacts is crucial for anyone facing a levy, as it emphasizes the urgent need for professional assistance to navigate the situation effectively.

Steps to Take Immediately After Receiving a Levy Notice

Receiving a levy notice can be alarming, but there are immediate steps you can take to mitigate the situation. First, review the notice carefully to understand the reason for the levy and the amount owed. This information is vital for formulating a response and determining your next steps. It’s essential to act quickly, as delays can lead to further complications.

Next, consider reaching out to a tax relief professional, like Rappaport Tax Relief, who can guide you through the process of responding to the IRS. They can help you file for a levy release, negotiate with the IRS, and explore options such as payment plans or settlements. Taking proactive measures can significantly improve your chances of resolving the issue favorably.

Common Misconceptions About IRS Levies

Many taxpayers hold misconceptions about IRS levies that can hinder their understanding and response to such situations. One common myth is that the IRS will automatically seize all your assets without warning. In reality, the IRS usually sends multiple notices before taking such drastic measures, allowing taxpayers opportunities to address their tax debts.

Another misconception is that once a levy is in place, it cannot be reversed. However, with the right strategies and professional assistance, many levies can be stopped or lifted. Understanding these misconceptions can empower taxpayers to take informed actions and seek help when facing IRS levies.

Preventing IRS Levies: Proactive Strategies

Preventing an IRS levy is often possible with proactive financial management and timely responses to IRS communications. Staying current on tax filings and payments is the first step in avoiding levies. If you find yourself unable to pay your taxes, it’s crucial to communicate with the IRS to explore options like installment agreements or offers in compromise.

Additionally, maintaining organized financial records and seeking assistance when needed can help you stay ahead of potential tax issues. Consulting with tax professionals can provide valuable insights into tax planning and compliance, significantly reducing the likelihood of facing a levy in the future.

Understanding the Impacts of IRS Levies

IRS levies can have significant consequences on your financial stability. When the IRS seizes your assets or freezes your bank account, it can disrupt your ability to pay bills, access funds for daily expenses, and maintain your standard of living. The stress of dealing with such actions can also affect your mental well-being and relationships.

Moreover, the implications of an IRS levy extend beyond immediate financial distress. It can lead to long-term damage to your credit score, making it challenging to secure loans or mortgages in the future. Understanding these impacts is crucial for anyone facing a levy, as it emphasizes the urgent need for professional assistance to navigate the situation effectively.

Steps to Take Immediately After Receiving a Levy Notice

Receiving a levy notice can be alarming, but there are immediate steps you can take to mitigate the situation. First, review the notice carefully to understand the reason for the levy and the amount owed. This information is vital for formulating a response and determining your next steps. It’s essential to act quickly, as delays can lead to further complications.

Next, consider reaching out to a tax relief professional, like Rappaport Tax Relief, who can guide you through the process of responding to the IRS. They can help you file for a levy release, negotiate with the IRS, and explore options such as payment plans or settlements. Taking proactive measures can significantly improve your chances of resolving the issue favorably.

Common Misconceptions About IRS Levies

Many taxpayers hold misconceptions about IRS levies that can hinder their understanding and response to such situations. One common myth is that the IRS will automatically seize all your assets without warning. In reality, the IRS usually sends multiple notices before taking such drastic measures, allowing taxpayers opportunities to address their tax debts.

Another misconception is that once a levy is in place, it cannot be reversed. However, with the right strategies and professional assistance, many levies can be stopped or lifted. Understanding these misconceptions can empower taxpayers to take informed actions and seek help when facing IRS levies.

Preventing IRS Levies: Proactive Strategies

Preventing an IRS levy is often possible with proactive financial management and timely responses to IRS communications. Staying current on tax filings and payments is the first step in avoiding levies. If you find yourself unable to pay your taxes, it’s crucial to communicate with the IRS to explore options like installment agreements or offers in compromise.

Additionally, maintaining organized financial records and seeking assistance when needed can help you stay ahead of potential tax issues. Consulting with tax professionals can provide valuable insights into tax planning and compliance, significantly reducing the likelihood of facing a levy in the future.