Levied by the IRS? Here’s What You Can Do—Before It’s Too Late

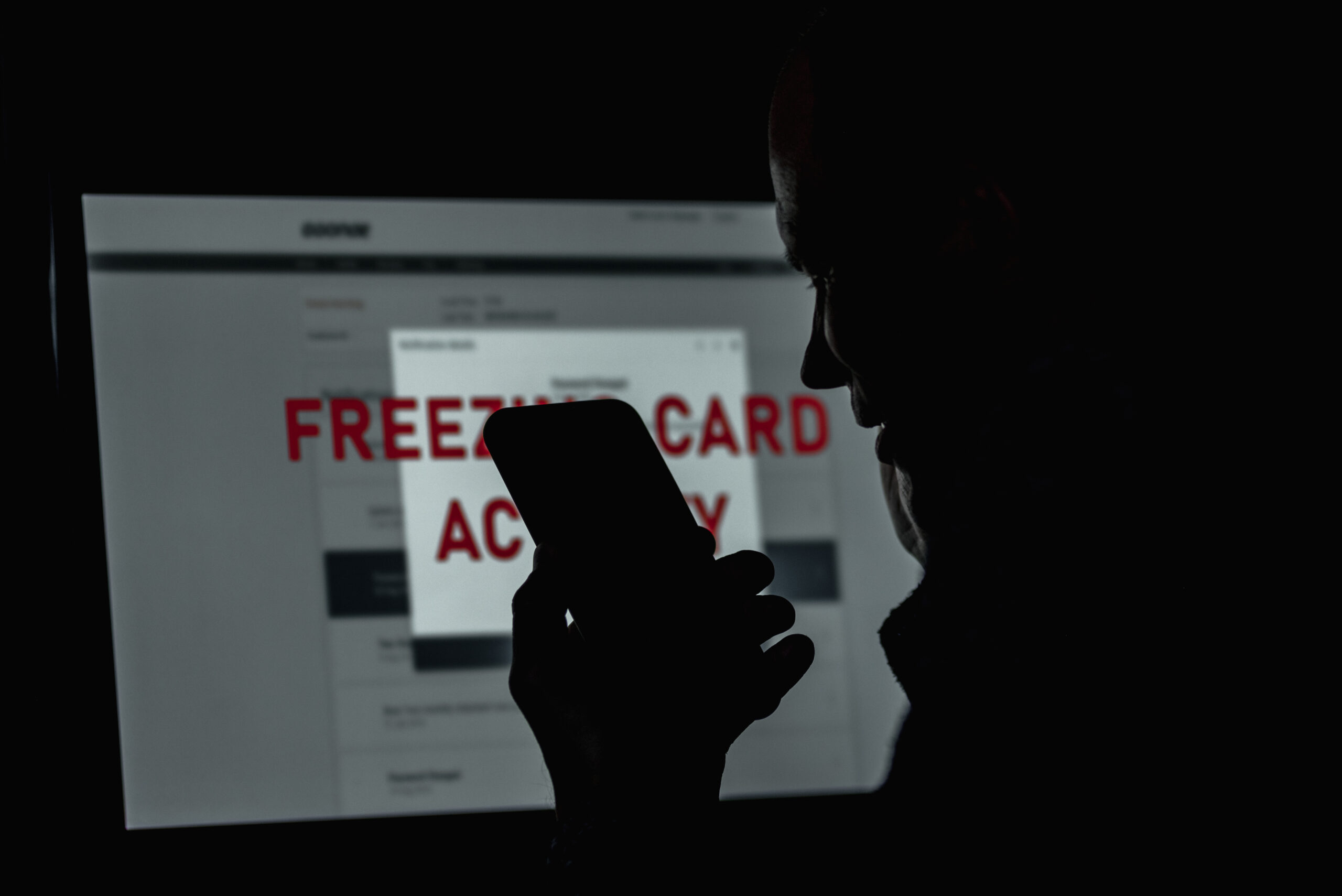

An IRS levy is one of the most aggressive actions the government can take. If your bank account has been frozen, or you’ve received notice of an impending asset seizure, time is of the essence.

At Rappaport Tax Relief, we act fast to stop levies, restore access to your finances, and resolve the tax debt that caused the issue in the first place.

What Exactly Is an IRS Levy?

Unlike a lien, which is a legal claim on your property, a levy allows the IRS to actually take your money or assets to satisfy unpaid tax debt. This can include:

Your bank account

Wages from your employer

Social Security payments

Even vehicles or real estate

If you’ve received a Final Notice of Intent to Levy, you typically have 30 days to act before enforcement begins.

Why IRS Levies Happen

Unpaid taxes for multiple years

Ignoring IRS notices

Failure to file returns

Rejected installment agreements

The good news: levies can often be stopped, reversed, or avoided entirely with strategic action.

How Rappaport Tax Relief Steps In

We move quickly to:

Contact the IRS and request a levy release

Demonstrate hardship or error

File missing returns or correct account discrepancies

Negotiate a payment plan, settlement, or temporary non-collectible status

🛡️ A levy doesn’t have to be the end—it can be the turning point. Contact Rappaport Tax Relief now for immediate help.