Blog and News

Owing the IRS more than $10,000 is not just a financial problem—it’s a legal one. At this threshold, the IRS ramps up enforcement actions that can include garnished wages, frozen bank accounts, and federal tax liens. But despite how serious it may seem, you still have rights, and there are clear paths to relief if you act quickly and wisely. Step 1: Respond Promptly to…

If you’ve received an audit letter from the IRS, don’t panic—but don’t ignore it, either. IRS audits are serious legal matters, and the outcome can have lasting consequences on your financial future. At Rappaport Tax Relief, we represent individuals and small businesses facing audits and examinations, ensuring that your rights are protected and that the process is handled…

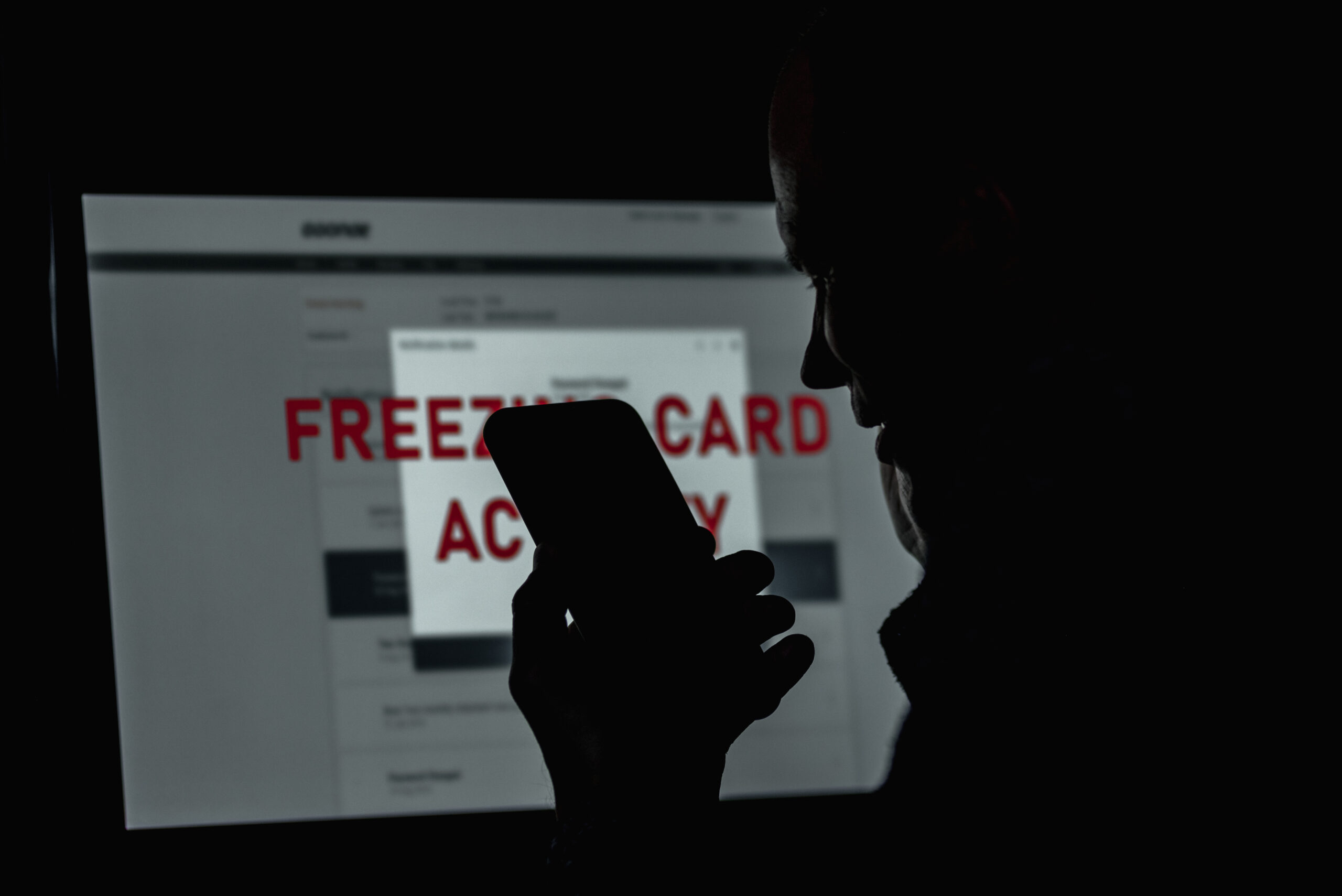

An IRS levy is one of the most aggressive actions the government can take. If your bank account has been frozen, or you’ve received notice of an impending asset seizure, time is of the essence. At Rappaport Tax Relief, we act fast to stop levies, restore access to your finances, and resolve the tax debt that caused the issue in the first place. What Exactly Is an IRS…

We Are Proudly Virtual

We’re proud to be virtual and serve both local and national clients. We are fully capable of serving clients across the country virtually and love connecting with our clients face-to-face when requested.