The High Stakes of Ignoring IRS Letters

An IRS notice isn’t a suggestion — it’s a formal warning that demands a response. Ignoring it can cost you far more than the original issue.

It starts with a basic letter explaining a discrepancy or balance due. With no reply, the IRS moves forward with collection. That can mean wage garnishments, liens against your property, or direct withdrawals from your bank account. Once those actions begin, stopping them is far harder than preventing them in the first place.

At Rappaport Tax Relief, we take immediate action to address IRS correspondence. We work to resolve the underlying issue, challenge incorrect claims, and negotiate solutions that protect your income and assets.

If there’s an IRS notice in your mailbox, don’t wait. Contact Rappaport Tax Relief now to keep the problem from getting worse.

IRS Bank Levies: Immediate Steps to Take

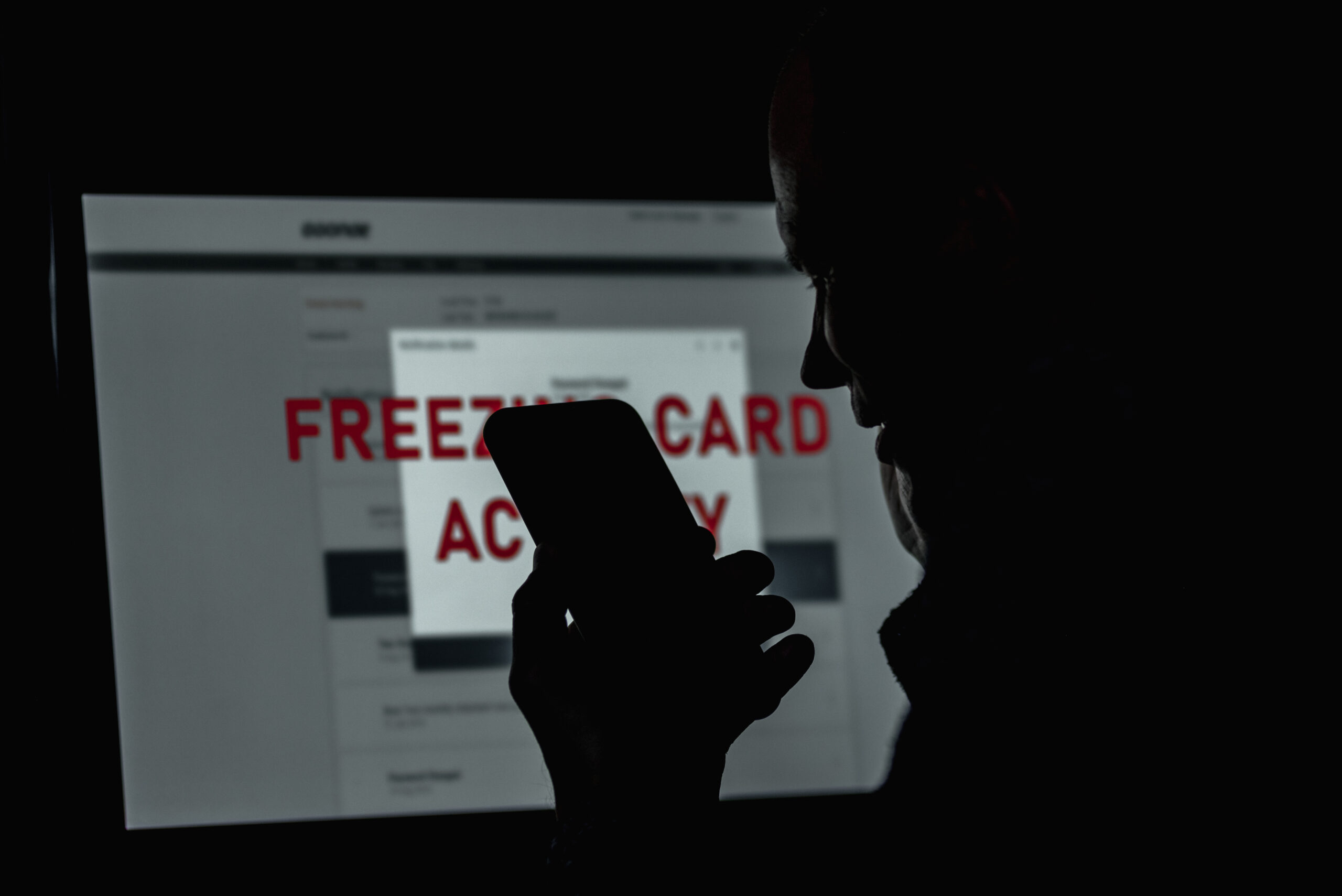

An IRS bank levy is more than an inconvenience — it’s a sign that the government is done waiting for payment. With this action, the IRS can legally freeze your bank account and, after 21 days, take the funds to cover your tax debt.

By the time a levy happens, the IRS has already sent multiple notices, including a Final Notice of Intent to Levy. If you don’t respond, they move forward — and your access to your own money is cut off.

At Rappaport Tax Relief, we treat bank levies as urgent emergencies. We work to open negotiations with the IRS immediately, pursuing solutions such as payment arrangements, hardship relief, or, in some cases, an Offer in Compromise. Our goal is to stop the levy, protect your remaining funds, and prevent future seizures.

Don’t wait until your account is emptied. Call Rappaport Tax Relief now if you’ve received a levy notice or found your funds frozen.

The Truth About IRS Penalties — And How to Get Them Removed

When tax debt starts piling up, IRS penalties often make the situation worse. What begins as a manageable balance can quickly become overwhelming once late fees, interest, and additional charges are added on.

At Rappaport Tax Relief, we’ve seen countless clients come in discouraged by penalty notices — not realizing that many of these penalties can be challenged or removed. If you're feeling buried under IRS charges, here’s what you need to know.

Why the IRS Issues Penalties

The IRS uses penalties to enforce compliance. Some of the most common include:

Failure to File – Up to 25% of the unpaid tax (5% per month)

Failure to Pay – 0.5% per month, with interest added on top

Failure to Deposit (for payroll taxes) – Up to 15% depending on how late the deposit is

While they’re meant to be a deterrent, penalties often hit people already facing financial or personal hardship — and in many cases, the IRS is open to reconsidering them.

Three Ways to Reduce or Eliminate IRS Penalties

1. First-Time Penalty Abatement (FTA)

If you’ve filed and paid on time for the past three years, you may qualify for this one-time waiver — even if your current situation is messy. It’s the easiest option for eligible taxpayers.

2. Reasonable Cause Relief

This requires proving that something outside your control prevented you from filing or paying on time. Examples include:

Natural disasters

Serious illness or injury

Loss of records

Death in the family

Unavoidable financial hardship

The IRS reviews each case individually, and documentation is critical.

3. Statutory Exceptions

In some rare cases, the IRS may reduce penalties if they made a mistake or if the taxpayer received bad advice from a qualified professional. This usually applies to complex cases — and requires specific legal arguments.

Timing Matters

Penalty relief isn’t automatic — and there are deadlines. Some must be requested within a specific time window, or you risk losing the right to challenge the charge.

At Rappaport Tax Relief, we help clients:

Identify which penalties they’ve been assessed

Determine which relief options apply

Prepare and submit effective requests

Appeal any unjust denials

Why a Professional Approach Works Better

A well-crafted penalty abatement request makes a difference. Simply saying, “I couldn’t afford to pay” often isn’t enough. We know how to build a persuasive case using the IRS’s own criteria and language — and we don’t hesitate to escalate a denial to the Office of Appeals when needed.

Take Control of Your Tax Debt

Penalties are frustrating, but they’re not final. In many cases, you may be able to reduce what you owe and get back on the path to resolution — especially with the right support.

If you’re struggling with tax debt and want to explore penalty relief, contact Rappaport Tax Relief today. We’ll help you understand your options and fight for a fair outcome.

How to Successfully Navigate a Tax Audit: Breaking It Down Phase by Phase

Receiving an IRS audit notice can feel overwhelming, but audits don’t have to result in disaster. Most audits are resolved efficiently when handled correctly — the key is understanding what’s happening at every stage and knowing how to respond.

At Rappaport Tax Relief, we guide taxpayers through audits by breaking the process into clear, manageable phases. Let’s walk through exactly what you should expect and what you can do at each step.

Phase 1: Audit Selection — Why You?

Not every audit is random. The IRS selects returns based on a variety of factors, including:

Computer algorithms: IRS systems flag discrepancies or patterns that deviate from statistical norms.

Mismatched information: Differences between your return and third-party reporting (W-2s, 1099s).

High-risk deductions: Home office expenses, large charitable donations, or excessive business losses relative to income.

Cash-intensive businesses: Retail, food service, salons, and trades tend to receive additional scrutiny.

Even if everything on your return is accurate, these factors can trigger an audit.

Phase 2: Notification — Understanding Your Audit Letter

Once selected, the IRS will send you a notice outlining:

The tax year(s) under review

The specific areas they want to examine

The type of audit: correspondence, office, or field

Carefully reviewing this letter is critical — it defines the scope of the audit. It’s also your first opportunity to get ahead of the process.

Phase 3: Preparing Your Response — Documentation and Organization

This is where preparation makes the biggest difference:

Collect relevant documents: Receipts, invoices, mileage logs, bank statements, etc.

Organize materials clearly: Well-organized records reduce questions and create a favorable impression.

Understand your return: Even if a preparer filed it for you, it’s important to review the numbers so you’re familiar with what’s being questioned.

If records are incomplete, don’t guess — a professional can help reconstruct documentation when necessary.

Phase 4: Audit Engagement — Best Practices During the Review

How you interact with the IRS is just as important as the records you submit. Remember these best practices:

Be respectful and cooperative: The IRS auditor is doing their job; a professional demeanor helps maintain a constructive tone.

Limit your responses: Answer only what’s asked — avoid offering unrelated information that could broaden the audit.

Document all interactions: Keep records of every letter, phone call, and meeting.

If you choose to engage professional representation, your tax attorney or enrolled agent can attend meetings, handle correspondence, and communicate directly with the auditor for you.

Phase 5: Conclusion — Understanding the Outcomes

When the audit concludes, you’ll receive an IRS report summarizing their findings. There are three potential outcomes:

No change: The IRS accepts your return as filed.

Agreement: You accept proposed changes and pay additional tax (possibly with penalties and interest).

Disagreement: You dispute the findings, triggering an appeals process.

Even if you disagree with the audit results, you have rights — including requesting a conference with an IRS appeals officer or taking your case to U.S. Tax Court.

Your Rights Throughout the Audit Process

At every stage, you are protected by a set of taxpayer rights:

The right to professional representation: You never have to deal with the IRS alone.

The right to clarity: You can ask for explanations if you don’t understand requests.

The right to appeal: If you disagree with the final determination, you can appeal.

Exercising these rights — properly and promptly — can greatly improve your audit experience.

Why Professional Guidance Matters

Audits often involve nuances: incomplete records, questions about specific deductions, or the risk that the audit could expand to other tax years. Professional guidance can help you:

Clarify the audit scope and ensure it stays focused

Present your records properly

Communicate effectively and strategically with the IRS

Protect your interests if the audit leads to negotiation or appeal

An experienced tax professional understands IRS procedures and can guide you toward the most efficient resolution.

Audit-Proofing Your Future

Even after your audit concludes, it’s worth improving your tax practices going forward:

Maintain records for at least 3–7 years

Keep receipts for all claimed deductions and credits

Avoid estimates — use precise numbers backed by documentation

Report all income, including freelance, gig work, and investments

Proactive recordkeeping is the best defense if you’re ever audited again.

Rappaport Tax Relief: Your Advocate for a Smooth Audit

An IRS audit can feel like a burden — but you don’t have to go through it alone.

At Rappaport Tax Relief, we help individuals and businesses navigate audits strategically, efficiently, and with peace of mind. We know what auditors look for and how to protect your rights while seeking the best possible outcome.

Call today for a free consultation — let’s work together to manage your audit from start to finish and protect your financial future.

IRS Asset Seizure: What It Means and How to Protect Your Assets Before It’s Too Late

When back taxes go unpaid, the IRS has many tools at its disposal — and one of the most severe is asset seizure. Unlike wage garnishments or bank levies, asset seizures target your physical property: your home, your vehicle, your business equipment.

If you’re falling behind on tax obligations, it’s critical to understand this process so you can take action before your property is taken.

What Is an IRS Asset Seizure?

An IRS asset seizure occurs when the IRS legally takes ownership of your tangible property to satisfy a tax debt. After seizure, the IRS typically sells the property at auction and applies the proceeds to your outstanding balance.

Property commonly seized includes:

Cars, trucks, RVs, and motorcycles

Real estate (including personal residences, with court approval)

Business inventory and equipment

Investment and financial accounts

Valuables like artwork, jewelry, and collectibles

This is one of the most aggressive steps the IRS can take — and one that can disrupt your life or cripple your business.

When Does the IRS Seize Assets?

Seizure isn’t immediate or without warning. The IRS must follow a formal collection process that gives you multiple opportunities to resolve your debt voluntarily:

Assessment: The IRS formally determines you owe a tax balance.

Notice and demand for payment: An initial bill is sent requesting payment.

Collection notices: Follow-up letters warn that enforcement will occur if no payment is made.

Final Notice of Intent to Levy: This letter provides a 30-day window for you to appeal or negotiate before seizure begins.

Seizure typically occurs when:

A taxpayer owes significant back taxes

There’s been no response to IRS communication

Assets exist that could be sold to satisfy the debt

Your Rights Before a Seizure

Even though the IRS has broad enforcement powers, you have important rights as a taxpayer:

The right to be notified: Before seizure, the IRS must send a Final Notice.

The right to appeal: A Collection Due Process (CDP) hearing can be requested within 30 days of this notice.

The right to propose alternatives: The IRS must consider reasonable payment plans or settlements.

Failing to act within this 30-day window significantly reduces your options and allows the IRS to proceed.

How to Stop an IRS Seizure

It’s possible to stop a seizure before it happens if you act quickly. Common resolution options include:

Installment Agreement: Monthly payments that satisfy IRS requirements and pause collection efforts.

Offer in Compromise: If you qualify, the IRS may accept less than what you owe.

Currently Not Collectible (CNC) status: If you can show paying would cause undue hardship, collections may be temporarily suspended.

Filing a timely appeal: Stops collection while your case is reviewed.

Each option requires careful planning, documentation, and negotiation — the right professional guidance can be crucial.

Why You Must Act Fast

Once the IRS seizes and sells your property, getting it back is nearly impossible — and you may still owe additional taxes, penalties, or interest. The IRS often sells property at auction for far less than its fair market value.

The key is to engage with the IRS before they act. Early intervention gives you more options and the best chance at resolving your tax debt while keeping your assets intact.

How a Tax Professional Can Help

The IRS collection system is complex, and navigating it alone can be overwhelming. A tax resolution professional can:

Evaluate your financial situation and review your IRS file

Determine which resolution option is best for your unique case

Handle negotiations and communications directly with the IRS

Ensure appeals or payment arrangements are filed properly and on time

Protect Your Property and Your Future

If you’re facing the threat of IRS asset seizure, don’t wait — every day counts.

At Rappaport Tax Relief, we specialize in protecting taxpayers from aggressive IRS collection tactics. We understand how the IRS operates and how to negotiate effective solutions that protect your rights and your assets.

Contact us today for a free consultation — let’s work together to safeguard your property and resolve your IRS tax debt before it’s too late.

What to Do If You Owe the IRS More Than $10,000

Owing the IRS more than $10,000 is not just a financial problem—it’s a legal one. At this threshold, the IRS ramps up enforcement actions that can include garnished wages, frozen bank accounts, and federal tax liens. But despite how serious it may seem, you still have rights, and there are clear paths to relief if you act quickly and wisely.

Step 1: Respond Promptly to IRS Notices

The IRS doesn’t start collections without warning. They’ll send letters—like CP504, LT11, or a Notice of Federal Tax Lien—outlining the amount you owe and the actions they plan to take. These notices aren’t suggestions. They have real consequences if ignored. Open every letter. Take note of every deadline. And don’t wait until enforcement has already begun.

Step 2: Understand the Full Scope of Your Tax Debt

Before jumping into a payment plan or negotiation, you need to know exactly what you owe and why. Request your IRS account transcript online at IRS.gov. It will show:

- Each tax year involved

- Total owed, including interest and penalties

- Any liens or enforcement activity already in place

Armed with this information, you can make informed decisions rather than reacting blindly.

Step 3: Explore IRS Resolution Programs

The IRS offers a number of tax relief options to help you get back on track. Depending on your financial circumstances, you may qualify for:

Installment Agreement – This spreads your debt into manageable monthly payments.

Offer in Compromise (OIC) – You may be able to settle your debt for less than the full amount if paying it would cause financial hardship.

Currently Not Collectible (CNC) – If you truly can’t pay anything at the moment, the IRS may suspend collection activities.

Penalty Abatement – If you have a legitimate reason—such as medical issues, job loss, or a natural disaster—you may be able to have some penalties removed.

Each of these programs involves complex qualification criteria, and applying incorrectly can lead to delays or denials.

Step 4: Avoid Knee-Jerk Reactions

Too often, taxpayers rush into agreements or worse—do nothing at all. Common mistakes include:

- Paying a portion with a high-interest credit card

- Applying for a program without eligibility

- Ignoring letters in hopes they’ll stop

Taking the wrong approach can limit your options and lead to enforced collection actions.

Step 5: Work With a Skilled Tax Relief Professional

When your debt reaches five figures, it’s time to get expert help. A seasoned tax relief professional can:

- Analyze your full financial profile

- Recommend the right IRS program

- Represent you in communications and negotiations

- Help you avoid garnishments, liens, and levies

If you owe over $10,000 to the IRS, Rappaport Tax Relief is here to guide you forward. Led by David Rappaport, our team offers honest, effective representation rooted in experience and strategy. Call now for your free consultation and let’s resolve your IRS issue—together.

Facing an IRS Audit? Here's How to Protect Yourself—and Your Finances

If you’ve received an audit letter from the IRS, don’t panic—but don’t ignore it, either. IRS audits are serious legal matters, and the outcome can have lasting consequences on your financial future.

At Rappaport Tax Relief, we represent individuals and small businesses facing audits and examinations, ensuring that your rights are protected and that the process is handled with precision and professionalism.

Types of IRS Audits

Correspondence Audit: Conducted by mail; usually limited to one or two issues.

Office Audit: Requires a visit to an IRS office with documentation.

Field Audit: The most serious type—an IRS agent visits your home or business.

Audits are often triggered by:

Unusual deductions

Mismatched income reports

Large charitable donations

Home office or business expenses

Self-employment income (especially cash-heavy industries)

What an IRS Audit Can Lead To

A bill for back taxes, interest, and penalties

Frozen refunds or tax liens

Adjustments to future tax returns

Potential fraud investigations (in rare cases)

Why You Need Representation

Going it alone often leads to overpayment, missed defenses, or even expanded investigation. With Rappaport Tax Relief:

We handle all communication with the IRS

Prepare and present supporting documentation

Fight for the lowest possible adjustment—or none at all

Appeal unfair outcomes, if necessary

📄 An audit doesn’t have to destroy your finances. Let Rappaport Tax Relief defend your case with confidence and clarity.

Levied by the IRS? Here’s What You Can Do—Before It’s Too Late

An IRS levy is one of the most aggressive actions the government can take. If your bank account has been frozen, or you’ve received notice of an impending asset seizure, time is of the essence.

At Rappaport Tax Relief, we act fast to stop levies, restore access to your finances, and resolve the tax debt that caused the issue in the first place.

What Exactly Is an IRS Levy?

Unlike a lien, which is a legal claim on your property, a levy allows the IRS to actually take your money or assets to satisfy unpaid tax debt. This can include:

Your bank account

Wages from your employer

Social Security payments

Even vehicles or real estate

If you’ve received a Final Notice of Intent to Levy, you typically have 30 days to act before enforcement begins.

Why IRS Levies Happen

Unpaid taxes for multiple years

Ignoring IRS notices

Failure to file returns

Rejected installment agreements

The good news: levies can often be stopped, reversed, or avoided entirely with strategic action.

How Rappaport Tax Relief Steps In

We move quickly to:

Contact the IRS and request a levy release

Demonstrate hardship or error

File missing returns or correct account discrepancies

Negotiate a payment plan, settlement, or temporary non-collectible status

🛡️ A levy doesn’t have to be the end—it can be the turning point. Contact Rappaport Tax Relief now for immediate help.

2025 Tax Survival Guide for Miami Small Businesses – From Olympus Tax Resolution

Running a small business in Miami in 2025 means navigating not just a more aggressive IRS, but also a dynamic local economy with unique pressures. With increased federal enforcement, tighter margins, and lingering financial disruptions from recent years, many South Florida business owners are finding it harder to stay ahead of tax obligations. Whether you operate a restaurant in Little Havana, a boutique in Wynwood, or a service business in Doral, IRS scrutiny is rising fast.

Olympus Tax Resolution has worked with countless Miami-area businesses that are now facing collections, liens, and bank levies they never saw coming. If your small business in South Florida owes back taxes or is starting to feel the pressure, here’s what you need to know—and what you can do about it.

IRS Red Flags in 2025: What’s Triggering Trouble?

- Missed or inconsistent 941 payroll deposits

- Multiple years of unfiled returns (business or personal)

- Fluctuations in reported income vs. actual deposits

- Use of contractors misclassified instead of W-2 employees

- Discrepancies between business tax returns and 1099s filed by others

The IRS now has faster tools to detect irregularities. They’re not waiting to audit; they’re sending letters and launching automated collections based on what their data models suggest. In a city like Miami, where many small businesses deal with seasonal cash flow and mixed income sources, these systems can misread your real situation—making it all the more urgent to respond properly.

Common IRS Actions Impacting Miami Businesses

- Immediate levies on business checking accounts held at local banks like BankUnited or City National Bank

- Merchant processor garnishments (especially Stripe, Square, or PayPal)

- Asset seizures, including vehicles or business equipment from work sites

- Revenue Officer visits, often without notice, to physical storefronts

- Assignment of personal liability via the Trust Fund Recovery Penalty (TFRP)

These disruptions can shut your business down before you’ve had a chance to fight back. But there are legal paths to stop the damage and resolve the debt.

Resolution Starts With Stabilization

If you’re already in IRS collections or getting threatening letters, your first priority is to stabilize the situation. Olympus Tax Resolution recommends a phased approach:

- Tax Account Investigation – Pull IRS transcripts and balances for your business and any responsible individuals.

- Compliance Restoration – Get all required returns filed and payroll deposits current.

- Financial Documentation – Organize profit/loss statements and business bank records to show what’s really possible.

- Protection from Collection – File requests to hold levies, liens, or officer visits while the resolution is in progress.

- Resolution Proposal – Submit an Offer in Compromise, payment plan, or hardship case based on financial ability and IRS guidelines.

Which IRS Options Can Actually Work for a Miami Business?

- Installment Agreements that reflect real-world cash flow—not what the IRS assumes you can pay

- Offer in Compromise that shows the business can’t stay open under the full tax burden

- CNC (Currently Not Collectible) designation if cash flow can’t support even a minimal payment

- Penalty Abatement using first-time abatement or reasonable cause arguments

Each of these routes requires strategy. Submitting the wrong documents or failing to protect yourself from further collection can result in immediate financial damage.

A 2025 Reality: The IRS Isn't Waiting

What used to take months now happens in weeks. We’re seeing IRS enforcement move much faster:

- Levies issued after one missed payment

- Field visits from Revenue Officers within 30 days of case assignment

- Automatic lien filings on balances over $10,000

- Notices of seizure with 10-day response deadlines

In Miami, this can mean Revenue Officers showing up at your Coral Gables office, lien filings tied to property in Hialeah, or garnishments hitting accounts in Brickell. Many local business owners are shocked at how fast enforcement hits.

Why Resolution is About More Than Just Numbers

Small business tax debt is about more than just dollars and cents. You’re fighting to:

- Protect your livelihood

- Keep your staff employed

- Maintain vendor relationships

- Stay in business long enough to recover

Olympus Tax Resolution understands that your business is more than a balance sheet—it’s your life. Their team is based in Miami and experienced in negotiating resolutions that balance legal accuracy, financial reality, and the urgency of keeping your doors open.

When your business is under pressure from the IRS, don’t guess your way through it. Let Olympus Tax Resolution guide you toward a solution that actually works in 2025’s tax climate—so you can move forward with confidence and control in the Miami business community.

Facing an IRS Bank Levy in 2025? Here's How Rappaport Tax Relief Can Help

An IRS bank levy can be one of the most distressing experiences for taxpayers.In 2025, the IRS continues to employ aggressive collection tactics, including bank levies, to recover unpaid taxes.Understanding how these levies work and how to respond is crucial.Rappaport Tax Relief offers expert assistance to individuals and businesses dealing with such tax challenges.

What Is an IRS Bank Levy?

An IRS bank levy is a legal action that allows the IRS to seize funds directly from your bank account to satisfy a tax debt.Unlike a lien, which is a claim against your assets, a levy actually takes your property to pay the debt.This can lead to frozen accounts and financial hardship if not addressed promptly.

The Process of a Bank Levy

The IRS follows a specific process before initiating a bank levy:

Notice and Demand for Payment: The IRS sends a bill outlining the amount owed.

Final Notice of Intent to Levy: If payment isn't made, the IRS issues a final notice at least 30 days before the levy.

Levy Execution: If no action is taken, the IRS instructs your bank to freeze your account.

21-Day Holding Period: The bank holds the funds for 21 days, giving you time to resolve the issue.

Funds Seized: If unresolved, the bank releases the funds to the IRS.

Impact of a Bank Levy

A bank levy can have severe consequences:

Immediate Financial Strain: Loss of access to funds can disrupt bill payments and daily expenses.

Credit Damage: Levies can negatively affect your credit score.

Business Disruption: For business owners, levies can halt operations by freezing necessary funds.

How Rappaport Tax Relief Can Assist

Rappaport Tax Relief offers personalized strategies to address and resolve IRS bank levies:

Immediate Action: They can contact the IRS on your behalf to halt the levy process.

Negotiation: Their team can negotiate payment plans or settlements suitable to your financial situation.

Representation: With extensive experience in tax resolution, they can represent you in all dealings with the IRS, ensuring your rights are protected.

Preventing Future Levies

To avoid future bank levies:

Stay Compliant: Ensure all tax filings are up to date.

Communicate with the IRS: Respond promptly to any IRS correspondence.

Seek Professional Help: Engage with tax professionals like Rappaport Tax Relief to manage your tax obligations effectively.

If you're facing an IRS bank levy or want to prevent one, Rappaport Tax Relief is here to help.With a commitment to resolving the root of your tax issues, not just the symptoms, their team is dedicated to guiding you through your unique situation towards financial freedom.